On Memes, Dreams, and Currencies (Part 3)

In 2002, John Cochrane wrote a research report retrospectively on the causes of the Nasdaq tech bubble, and speculated that one of the likelier causes for the bubble (in his report, he details the Palm/3Com acquisition as an example) was the idea of a “convenience yield” (the non Lily-ism term for liquidity value). Looking retrospectively he identified a potential causal mechanism for “the madness of the crowds”—in a regime of unbridled liquidity, characterized by:

High turnover (large volume relative to float daily)

High price volatility

Restrictions on short selling

Strong uncertainty about fundamentals/expectation

rational traders should necessary pay a “convenience yield”: an expectation of positive profit due to a short holding time.

The year is 2021, and I could’ve just as easily replaced in that paragraph Palm/3Com with Gamestop, AMC Theaters, or Bitcoin itself. In fact, time is a flat circle — all of the critical stylistic facts Cochrane identified ring true. And of course, I became the unknowing popularizing of his ideas, nearly 20 years later, inventing them a priori by staring in the belly of the meme abyss, and seeing the signs of a bubble all around me.

—-

Let’s take a step back and talk about what money is. Most of us have an intuitive understanding of what money is:

If you’re not an economist though, you probably don’t spend much time thinking about what money is past that Simpsonian statement, and the finer details rarely matter in daily life.

Money is a weird concept when you think about it for a while, much like the idea of clothes or the word enough or that people buy products like:

But classically, economists have denoted the three functions of money:

A store of value

A unit of account

A medium of exchange

There are a lot of competing theories on what each of those terms actually mean, and what contributory impact each has to monetary valuation. In fact, there exists an entire field called monetary economics which specifically studies the role of money and the different competing theories about money. That said, I am not an economist, although I did watch A Beautiful Mind when I was 16 and that’s probably why I’m in finance now. In this framework, I am going to analyze it in a much different perspective. It, like all my other posts, should be considered mostly entertainment value.

The Coincidence of Wants

In the beginning, we all bartered for things. Without delving into jargon of utility and all that fun stuff, the objective of barter is simple:

I need or want something you have.

You need or want something I have.

You want the thing I have more than you want the thing I want.

I want the thing you have more than I want the thing I have.

We can both be happier/better off trading with each other.

This is pretty implicit and borderline animalistic, and no one could reasonably argue that, assuming the above statements hold true. In practice, this requires a “coincidence of wants”: not only must we both want something from each other more than an item we have, but we must have the items at the exact same time.

While this is doable at the scale of Pokemon cards, it becomes terribly difficult in large groups, or when the items spoil (like food). Additionally, it has issues with granularity of utility. That sounds fancy, but we can look at a simple example.

Let’s imagine a world with two humans, A and B. They will simply do the action that maximizes their utility score at any given point (this is roughly assumption of rationality).

A has 3 apples, and assigns 5 utility points to each. This gives A a net utility of 15. B conversely has 4 watermelons, and assigns 7 utility points to each. A, however, loves watermelons, and would assign one 10 utility points. B, similarly, loves apples, and would assign 8 utility points to getting one.

So A and B should barter. A can trade with B, an apple for a watermelon. After the transaction is over, A will now have 20 utility points, and B will have 29 utility points. It’s clear from this transaction that B only increased by 1 utility point, while A increased by 5. A, we could say, benefited more.

The issue here is that you can’t trade halves or eighths in this world of an apple or watermelon. So B could potentially have benefitted from a more granular trade with A (for example, if utility can be fractionated, B could’ve offered 3/5ths of a watermelon to A and A would strictly be better off still).

So barter has issues.

As society got more complicated, we realized a few things:

1) It was pretty unwieldy to carry goods everywhere, and food tends to spoil.

2) It’s kind of a bummer that you can only trade whole motorcycles or cows.

So we invented money, and units of money.

What is Money?

So we still haven’t actually defined what money is, not even in the weird taxonomy of Lily terms. For most of human history, we tied the idea of money to something else. In general, this “thing” tended to be a precious metal, mostly because ape brain does like shiny rocks, and they were moderately rare (this usually worked until it didn’t and sometimes led to inflation, like when Mansa Musa decided to visit you).

For most of human history as well, we tended to like a monarchical or autocratic style of government, where one of the ultimate powers of the State was simple — the State could issue money.

The most trivial way to value money that is tied to something else, of course, was to value that something else as a unit of that money. It worked for the Romans, kind of:

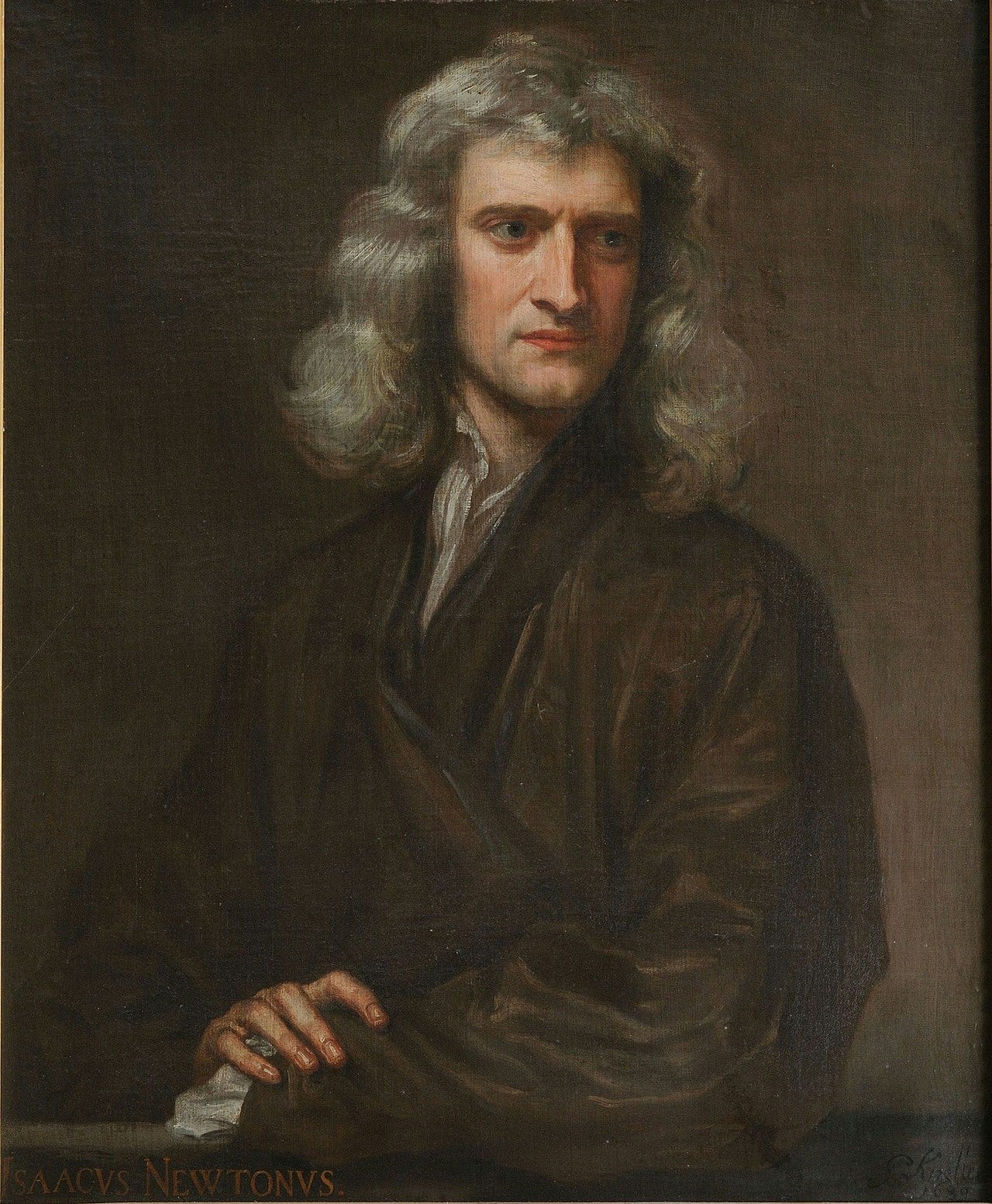

The issue of this of course, is some Very Smart people figured out you could shave the sides of the coin, and for the most part, other folks didn’t notice. Since the metal of the coin was valuable, this practice was lucrative. We called it “coin debasement”, and this guy is a bit famous for trying to rout it out (among other things):

Over time, the value of the metal that made up the physical significantly detached from the value of the actual currency it represented. This differential is known as seigniorage — the right of the government (or more generally, a currency issuer) to make profit by minting coins cheaper than the actual face value of the coin.

This wasn’t a huge deal, until this guy:

After World War II, the mostly destroyed countries of the world got together and decided it would be a fantastic idea to let the United States largely dictate the international monetary system. While pegging to gold was considered Generally a Good Idea, Bretton Woods had issues, mainly because when times got a bit tough, everyone realized there was little point in:

1) Giving America “the exorbitant privilege” of being the world’s reserve currency (since it held all the gold, more or less)

2) Not being able to really control your own money supply when you might want to (this point still occupies mindshare rent free for goldbugs everywhere).

That said, I’m not here to argue the merits of Bretton Woods, mostly because I have only a finite number of brain cells left and I’d like to preserve them for future posterity.

—-

Liquidity Value and Fiat Currency

There are reasonably cogent arguments about valuation of currency as a store of value and unit of account. The latter it’s hard to argue imbues money with “value” per se, in the sense that I could reasonably also weigh my transactions in dung-beetles assuming I could assign utility to possessing those.

That said, let’s also examine the properties of what a “unit of account” is. A unit of account, by definition, allows us to price objects and settle debts, which implies transactional value. To give an extreme example, in a static universe where every individual had some things but no ability to buy or sell them (let’s imagine they’re very far apart, or they use social media and have slightly different political views), there would be no need for a unit of account. If we change the example slightly and allow two agents to transact but not the rest, we can observe simply that the value of having a unit of account is proportional to the amount of utility gained from transacting.

Sounds like a liquidity value? It’s a liquidity value.

In the Lily taxonomy, we can separate the three uses of money — a unit of account, a medium of exchange, and a store of value — into really just two units:

Liquidity value - Unit of account, medium of exchange

Fundamental value - Store of value (sort of)

For most of human history, when we pegged money to “things”, there was a strong fundamental floor. If I pegged a unit of money to sugar for example, the value of the currency was tautologically determined by sugar supply and demand, rather than its usefulness as a medium of exchange (since if no one was around, I could just eat the sugar). Of course per the previous posts there’s some extra value attached to the ability to buy and sell with it, but there was true, fundamental value there.

The issue of course with currency is it’s generally not considered a good idea to make it edible. For one, it causes some instability in the money supply, and following that, you probably don’t want to eat something everyone touched anyway. This is one of the many reasons why precious metals were used for most of our civilization — although they do possess fundamental value (they’re shiny, they’re poor conductors, a few other properties I can go on Wikipedia and remember). Fundamental value tends to be critically important in low-trust, decentralized societies — at the feudal level, the idea of a nation-state was a nebulous concept.

The idea of fiat currency evolved largely in parallel (well after the invention of proto-money, like bills of exchane) with the evolution of states themselves. In the Lily taxonomy, fiat currency has no or minimal fundamental value — without the ability to transact, a dollar is more or less worthless (unless you intend to burn it or use it as toilet paper or wallpaper, a la Weimar Germany hyperinflation).

It turns out when you separate the idea of liquidity value from fundamental value, you must have a strong rationale to back it up. When central governments are weak, it’s hard if not impossible to understand why a rational agent would exchange a fundamentally valuable item (like an apple) for a promissory of value (the fiat currency).

Fiat currency, it turns out, is one of the purest expressions of liquidity value. With minimal approximation, we could argue that a fiat note is fully liquidity value.

If we take our understanding from Part 2, we can see a strong parallel of the value of fiat currency and meme stocks — both have enough liquidity value to allow valuation to be sustained above fundamental value for prolonged periods of time.

But is it forever?

There are a few interesting properties about money that are worth discussing here:

1) In a vacuum, fiat currency is worthless or nearly so. A dollar without the ability to ever transact is the paper it’s printed on.

2) Given that, if we imagine the world and all its transactions as an iterated game, we can imagine at some point there will be a “last dollar spent”. By our first point, that dollar will never be spent. Therefore the person should not accept it, because that dollar is worthless.

3) This means the prior dollar is now the new last dollar spent, and it has no value. And so on.

4) Despite all the previous points, in normal life, if you offer me $2,000 or a laptop valued at $2,000 on the open market, I’d in almost all situations choose the cash.

Experiments have been that have observed, at least promisingly, that in very short games (for instance, 3 rounds), eventually participants will stop trading completely, due to the infinite regress described in 1 to 3). Even in the most strict scenario, however, we expect money debasement rather than complete worthlessness, assuming some degree of uncertainty of “what the last turn is”. That said, the real world rarely operates like this, because I assume that I will die well before US Dollars stop changing hands. Therefore, as long as the date money is extinguished is far in the future, I should readily treat it as a non-issue. We assume based on decades of economic and psychological research that agents do not perform infinite regress when determining actions, but tend to make decisions limited by complexity and time. Still:

What’s interesting is 4, and that’s the crux of the question of money. Despite the apparent implied worthlessness of fiat currency, a rational agent would almost always choose to pick the cash over a given item. This could differ in situations where the item is unavailable or there’s a sense of urgency attached to getting the item, but generally holds true (I would rather be paid in dollars than EtherRocks, for example, even if I intend to ape my dollars directly into them).

The reason money, or liquidity value, tends to be more valuable than things, is because it gives us choice. In a more abstract notion, we can go back to the apple and watermelon example of two transacting agents. In the case we discussed for barter, A is clearly getting the better deal versus B. If we created an agent C who could provide a better trade than A did, B should rationally trade with C over A every single time. Even if we created the universe instead so that C would only provide an equally good trade to A, from the position of B they’re no worse off than before C came.

This provides us with a critical observation: all liquidity values, necessarily, should increase or remain the same given a new agent accepts buying or selling it. This is because, assuming that utility for a trade here is unbounded (perhaps there is a Z who comes down from space and offers to give B an item worth 10^10^10 utility points), B will always prefer, in the absence of other extenuating factors (urgency or unavailability, for example), the ability to choose between goods versus being given one good.

An easy, more mathematical approach to think about this:

If you and I were playing a game where we drew a random, positive number and I gave you the maximum number returned of all draws, you will always be better off or no worse asking (or, if I charged for entry, paying 0 or more extra dollars) for another turn.

—-

This has, perhaps, a pretty two important implications:

1) Liquidity value should have, under normal* circumstances, fairly equivalent or slightly greater value than fundamental value - The caveat here of course is normal is doing the heavy lifting here. Assuming I have an asset with liquidity value that behaves the following way:

There is no urgency and or supply shortage

We’re dealing with risk-neutral agents

Tautologically, given liquidity value scales with the expectation of all future buyers and sellers of an asset, we expect a high liquidity value to imply high acceptance at least locally. This has an intuitive derivation - we value our dollars according to our ability to use them (for others around us to accept dollars as a means of payment). Similarly, those individuals must have similar reasoning for accepting dollars - they value the dollars similarly according to their ability to use them. This continues infinitely, where the value of the dollar must largely locally depend on one’s ability to use it, but there is implicit factoring of all future usage of the dollar (e.g. your neighbors, your neighbors’ neighbors, and so on).

In the case of liquidity value, we can still quantify value in regret-units (identical to fundamental value), given in the singular transaction case we can observe the value of liquidity is largely a matter of slippage/transaction cost — in a very liquid market, we incur less loss when holding the asset and deciding to sell, or when we wish to own the asset and decide to buy.

However, there’s a different but interconnected interpretation of liquidity — liquidity is a measure of choice. This is conditional on the decision to buy (sell): in a liquid market (of any type of transaction) there is choice to get a more preferable offer for same trade of utility. Fiat money, in the best of cases, acts as both a bearer of high liquidity (exchange of dollars for items, or even in foreign exchange tends to have low bid/ask spreads), but perhaps more so acts as the intermediary of choice — we like money simply because it gives us more options on how to spend it.

This is largely, at least in the mathematical case, due to uncertainty about transactional utility. Or in English — if we imagined a perfect information world, where ahead of every transaction you know all the potential ways you could’ve spent the same money, as well as the amount of value you’d be getting for your dollar, then choice should be tacitly irrelevant. If you have perfect information, you’d rationally always trade in a way to maximize the utility gained from the trade (or refuse to trade). However, in the real world agents operate with substantial degrees of both uncertainty as well as decision complexity, so the existence of currency allows us to sidestep both concerns.

What’s interesting is that both the value of choice and the transaction cost model of liquidity are the same value! We can see why: when we discuss transaction costs, there’s a strong element of competition. This is obvious to anyone who has ever made a market — this is supply and demand. If I am holding an asset (supplying it), increasing levels of demand will, up to a point, reduce the distance between the price I want to sell it and the price I can actually sell it at. This of course only works to a point — there is still an equilibrium price and it’s potentially true that even in infinite liquidity, no seller will want to accept my price. Similarly, if I intend to buy the asset (demanding it), increasing levels of supply will reduce the distance between the price I want to buy it and the price I can actually buy it.

This is identical to the choice argument — increasing demand (supply) implying more individuals are willing to transact with me for that asset, and therefore giving me more choice.

This provides us a straightforward linkage between liquidity value and fundamental value - I am willing to exchange a fundamentally valuable item (like a burrito or premium salami) for an item representing liquidity value (dollars), because I value the increased ability of choice. This, again, requires imperfect information between agents — if I know my premium salami is the most valuable item on Earth, I would never willingly sell it (unless I could, for example, sell it for dollars and the sum of items I could buy with said dollars would exceed the salami’s fundamental value).

Perhaps this observation gives a philosophical interpretation of the bid-ask spread, and the cost of selling (buying) — when I buy an item I am giving up the ability to choose after the transaction occurs (or rather, I am exchanging an asset with high liquidity for an asset with lower liquidity). The same occurs when I sell an asset — I am exchanging an illiquid asset for a more liquid one. By this argumentation, there should naturally be a spread (perhaps an infinitesimal one) — I should be willing always to buy an asset for slightly less than I’m willing to sell it for, given the loss of liquidity.

2) Liquidity value is moneyness - The final observation of this lengthy post is simply this — liquidity value is what gives money its property of moneyness! In fiat currency, we can argue to a high degree that all the value of money comes from the network of individuals that will agree to transact in it. This is further enforced by the existence of a government, which adds stability by backing the value of the currency, either by threat of violence or other mechanisms. In commodity money, conversely, most of the value of the “money” is from the fundamental value, with liquidity value contributing a much lesser fraction of the valuation.

What’s useful here is it gives us a natural continuation to the liquidity of non-”money” objects. We can observe the same premium (richer current valuation) in stocks, bonds, and other assets. It turns out all assets have some degree of moneyness to them!

—-

Well, this was a long post and a long series. In the final post, I want to extend this argument to discussion of cryptocurrencies and NFTs, and bring us home in terms of developing a mathematical framework to describe how to measure their liquidity value.

Stay classy San Diego,

Lily